Unified Pension Scheme 2024: Cabinet Approves Assured 50% of Salary as Pension for Government Employees The Indian government recently made a significant decision that impacts millions of government employees across the country. On the 24th of August 2024, the Cabinet, under the leadership of Prime Minister Narendra Modi, approved the Unified Pension Scheme (UPS). This scheme promises to provide government employees with an assured pension amounting to 50% of their average basic salary in the last 12 months before retirement. This move comes after extensive consultations and discussions, making it one of the most anticipated changes in the pension system for government employees.

QUICK INFORMATION

| Feature | Details |

|---|---|

| Assured Pension Amount | 50% of the average basic salary in the last 12 months before retirement. |

| Family Pension for Spouses | 60% of the pension amount for the spouse after the employee’s demise. |

| Minimum Assured Pension | ₹10,000 per month, ensuring a basic financial support level. |

| Inflation-Linked Pension Adjustments | Pension amounts adjusted based on the All India Consumer Price Index (AICPI) for Industrial Workers. |

| Lump Sum Payment at Superannuation | 10% of combined basic pay and DA for every six months of service, paid as a lump sum at retirement. |

| Flexibility | Option for employees under NPS to switch to UPS; states can adopt the UPS framework for their employees. |

Background: The Need for a Unified Pension Scheme

Government employees have always played a crucial role in the functioning of society. From teachers and healthcare workers to administrative staff, their contribution ensures the smooth operation of public services. However, the issue of social security, particularly post-retirement benefits, has been a long-standing concern. Over the years, various governments have made attempts to address these concerns, but the demand for a more comprehensive and assured pension scheme has persisted.

The National Pension System (NPS) was introduced as a replacement for the old pension scheme. However, it faced criticism from various quarters, especially from government employees who felt that the NPS did not provide enough security post-retirement. The demand for a more robust and assured pension system led to the formation of a committee in April 2023, headed by Dr. Somnath, the then Finance Secretary and now the Cabinet Secretary-designate.

The Formation of the Unified Pension Scheme

The committee formed by Prime Minister Modi undertook extensive consultations with over 100 unions and associations representing government employees. These discussions were not limited to central government employees but also included representatives from various states. The committee also consulted financial institutions like the Reserve Bank of India (RBI) and international bodies like the World Bank to understand global best practices in pension schemes.

ALSO READ

- Assam Police SI Recruitment 2024, Sub Inspector Vacancies @ slprbassam.in

- PSSSB Sewadar Chowkidar Recruitment 2024 Notification- Qualification, Age Limit, Application Fee and How to Apply Online

After these exhaustive consultations, the committee recommended the formation of the Unified Pension Scheme (UPS). The proposal was thoroughly reviewed, and finally, the Cabinet approved it, marking a significant shift in the pension policy for government employees.

Key Features of the Unified Pension Scheme

The Unified Pension Scheme is built on five key pillars, each designed to address specific concerns raised by government employees.

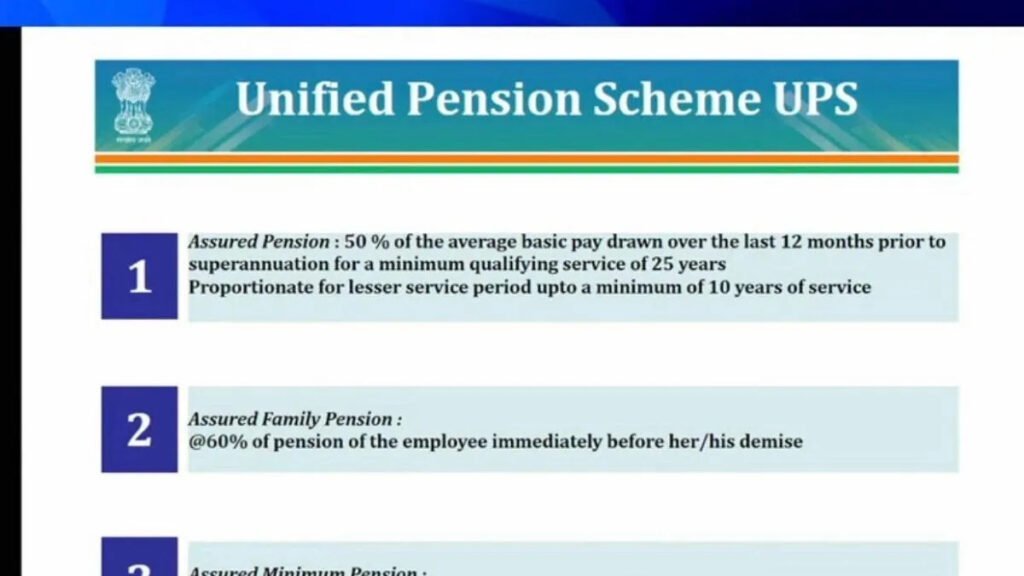

1. Assured Pension Amount

One of the primary demands of government employees was the assurance of a fixed pension amount. Under the UPS, employees are guaranteed a pension amount that is 50% of their average basic salary for the 12 months preceding their retirement. This ensures that employees have a predictable and secure income post-retirement, helping them plan their finances better.

For example, if an employee’s average basic salary in the last 12 months before retirement is ₹50,000, they will receive a pension of ₹25,000 per month. This assured amount provides financial security and stability for retirees, allowing them to maintain a decent standard of living even after their active service years.

2. Family Pension for Spouses

The second pillar of the UPS addresses the need for a secure income for the employee’s family in case of their demise. If a government employee passes away, their spouse is entitled to 60% of the pension amount that the employee was receiving. This provision ensures that the family is not left in financial distress after the loss of the primary breadwinner.

For instance, if the deceased employee was receiving a pension of ₹25,000, their spouse would receive ₹15,000 per month as a family pension. This support is crucial for the well-being of the family, providing them with the necessary financial assistance during difficult times.

3. Minimum Assured Pension

The third pillar of the scheme ensures a minimum assured pension of ₹10,000 per month. This provision is particularly beneficial for employees with shorter service durations, where their contributions might not be sufficient to yield a substantial pension amount. This minimum pension acts as a safety net, ensuring that all retirees receive a basic level of financial support.

For example, if an employee’s pension calculations based on their contributions result in a pension of ₹8,000, the scheme ensures that they receive at least ₹10,000 per month. This provision protects employees from financial hardships due to insufficient pension amounts.

4. Inflation-Linked Pension Adjustments

Inflation can erode the value of a fixed pension over time. To address this, the UPS includes a mechanism for inflation-linked adjustments. The pension amounts, including family pensions and minimum pensions, will be adjusted based on the All India Consumer Price Index (AICPI) for Industrial Workers. This ensures that the purchasing power of the pensioners remains intact, providing them with adequate financial security.

For instance, if the inflation rate increases by 5%, the pension amount will be adjusted accordingly to reflect this increase. This feature helps retirees maintain their standard of living even in the face of rising prices.

5. Lump Sum Payment at Superannuation

The fifth pillar of the UPS is the provision for a lump sum payment at the time of retirement. In addition to the regular pension, employees will receive a lump sum amount based on their length of service. For every six months of service, the employee will receive an amount equivalent to 10% of their combined basic pay and dearness allowance.

For example, an employee with 30 years of service and a combined monthly pay and DA of ₹60,000 would receive a lump sum amount of ₹3,60,000 at the time of retirement. This additional amount can be used by retirees to meet significant post-retirement expenses, such as medical bills or home renovations.

The Impact of the Unified Pension Scheme

The introduction of the Unified Pension Scheme is expected to benefit approximately 23 lakh government employees across the country. It provides them with a more secure and predictable retirement plan, addressing many of the concerns that were raised with the NPS.

One of the critical aspects of the UPS is its flexibility. Employees currently under the NPS have the option to switch to the UPS if they find it more beneficial. This flexibility ensures that employees can choose the pension scheme that best meets their financial needs and retirement plans.

Moreover, state governments have the option to adopt the UPS framework for their employees. This opens the door for a more unified and consistent pension policy across the country, ensuring that government employees, regardless of their state, have access to similar retirement benefits.

Conclusion: A New Era for Government Employee Pensions

The approval of the Unified Pension Scheme marks a significant milestone in the Indian pension system. It reflects the government’s commitment to addressing the long-standing concerns of government employees regarding their post-retirement financial security. By ensuring a fixed pension amount, providing for family pensions, and linking pensions to inflation, the UPS offers a comprehensive solution that meets the diverse needs of retirees.

This scheme is not just a financial plan; it is a recognition of the invaluable service that government employees provide to the nation. With the introduction of the UPS, retirees can now look forward to a secure and dignified life post-retirement, free from financial worries.

As the scheme rolls out in the coming months, it is expected to bring about a positive change in the lives of millions of government employees, providing them with the peace of mind that their financial future is secure. The Unified Pension Scheme is indeed a step towards a more inclusive and equitable retirement system for government employees in India.